RBGPF

0.0000

Asian markets collapsed Monday after China hammered the United States with its own hefty tariffs, ramping up a trade war that many fear could spark a recession.

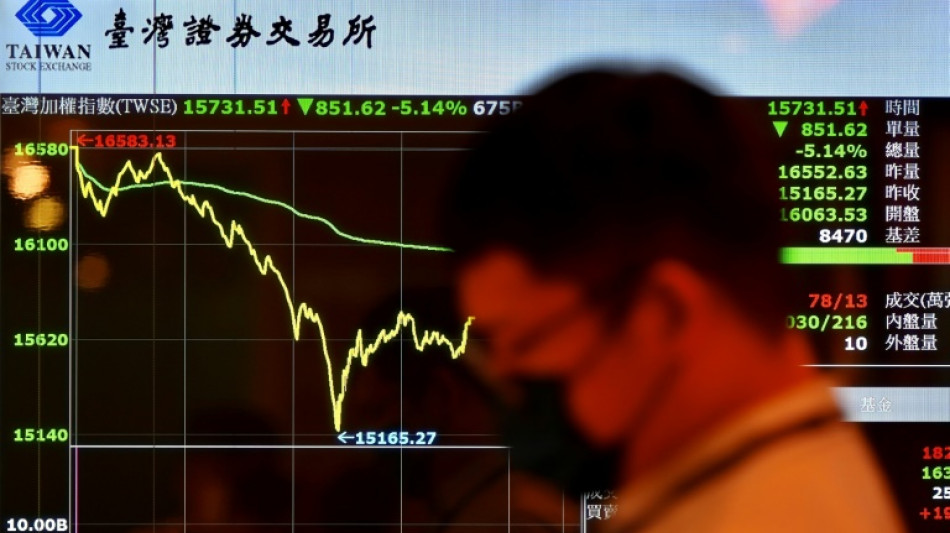

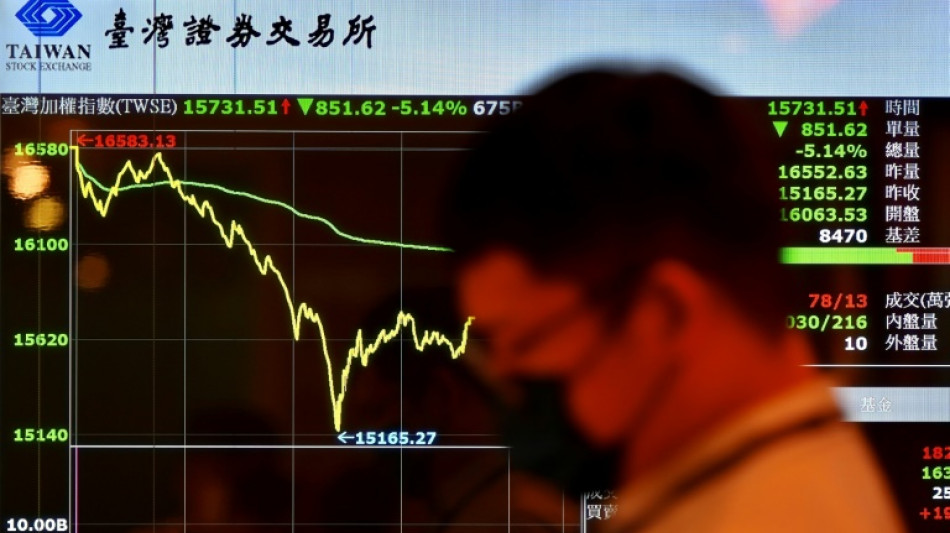

Trading floors were overcome by a wave of selling as investors fled to the hills on the worst day for equities since the pandemic, with Hong Kong shedding more than 10 percent, Tokyo diving eight percent and Taipei more than nine percent.

Futures for Wall Street's markets were also taking another hammering, while concerns about the impact on demand also saw commodities slump.

Donald Trump sparked a market meltdown last week when he unveiled sweeping tariffs against US trading partners for what he says was years of being ripped off and claiming that governments were lining up to cut deals with Washington.

But after Asian markets closed on Friday, China said it would impose retaliatory levies of 34 percent on all US goods from April 10.

It also imposed export controls on seven rare earth elements, including gadolinium -- commonly used in MRIs -- and yttrium, utilised in consumer electronics.

Hopes that the US president would rethink his policy in light of the turmoil were dashed Sunday when he said he would not make a deal with other countries unless trade deficits were solved.

He denied that he was intentionally engineering a selloff and insisted he could not foresee market reactions.

"Sometimes you have to take medicine to fix something," he said of the ructions that have wiped trillions of dollars off company valuations.

-- No sector spared --

The selling in Asia was across the board, with no sector unharmed by the savage selling -- tech firms, car makers, banks, casinos and energy firms all felt the pain as investors abandoned riskier assets.

Among the biggest losers, Chinese ecommerce titans Alibaba and JD.com tanked more than 11 percent, while Japanese tech investment giant SoftBank dived more than 10 percent.

Shanghai shed more than five percent and Singapore more than six percent, while Seoul gave up more than five percent triggering a so-called sidecar mechanism -- for the first time in eight months -- that briefly halted some trading.

Concerns about demand saw oil prices sink more than three percent Monday, having dropped around seven percent Friday. Both main contracts are now sitting at their lowest levels since 2021. Copper -- a vital component for energy storage, electric vehicles, solar panels and wind turbines -- also extended losses.

"The market is in free-fall mode again, punching through floors," said Stephen Innes at SPI Asset Management. "Trump’s team isn't blinking. The tariffs are being treated as a victory lap, not a bargaining chip."

The losses followed another day of carnage on Wall Street on Friday, where all three main indexes fell almost six percent.

That came after Federal Reserve boss Jerome Powell said US tariffs will likely cause inflation to rise and growth to slow and warned of an "elevated" risk of higher unemployment.

The measures by Trump are likely to give US central bankers a headache as they try to balance the need for interest rate cuts to support the economy with the need to keep a lid on prices.

His comments came after Trump had insisted "my policies will never change" and urged the Fed to cut rates.

"Powell's hands are tied," said Innes. "He’s acknowledged the obvious -- that tariffs are inflationary and recessionary -- but he's not signalling a rescue.

"And that's the problem. This time, the Fed's inflation mandate is forcing it to keep the safety net rolled up while asset prices get torched."

Tim Waterer, chief market analyst at KCM Trade, said: "Traders are nervously watching the two biggest economies going toe to toe on tariffs and are fearing that both could receive knockout blows from a prolonged economic fight.

"Neither the US nor China are backing down when it comes to slapping new tariffs on each other and in this escalatory environment it's not surprising to see that risk assets are being avoided like the plague."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 6.5 percent at 31,591.84

Hong Kong - Hang Seng Index: DOWN 9.3 percent at 20,725.20

Shanghai - Composite: DOWN 6.1 percent at 3,138.32

West Texas Intermediate: DOWN 2.2 percent at $60.66 per barrel

Brent North Sea Crude: DOWN 2.2 percent at $64.14 per barrel

Dollar/yen: DOWN at 146.04 yen from 146.98 yen on Friday

Euro/dollar: UP at $1.0964 from $1.0962

Pound/dollar: UP at $1.2908 from $1.2893

Euro/pound: DOWN at 84.94 pence from 85.01 pence

New York - Dow: DOWN 5.5 percent at 38,314.86 (close)

London - FTSE 100: DOWN 5.0 percent at 8,054.98 (close)

(Y.Yildiz--BBZ)