SCS

0.0200

Stock markets were mixed Monday with US indices retreating from records as President Donald Trump's aggressive trade policy came back to the forefront, reviving worries about trade wars and inflation.

"Tariff threats look likely to take center stage yet again this week, following further developments over the weekend," noted Richard Hunter, head of markets at Interactive Investor.

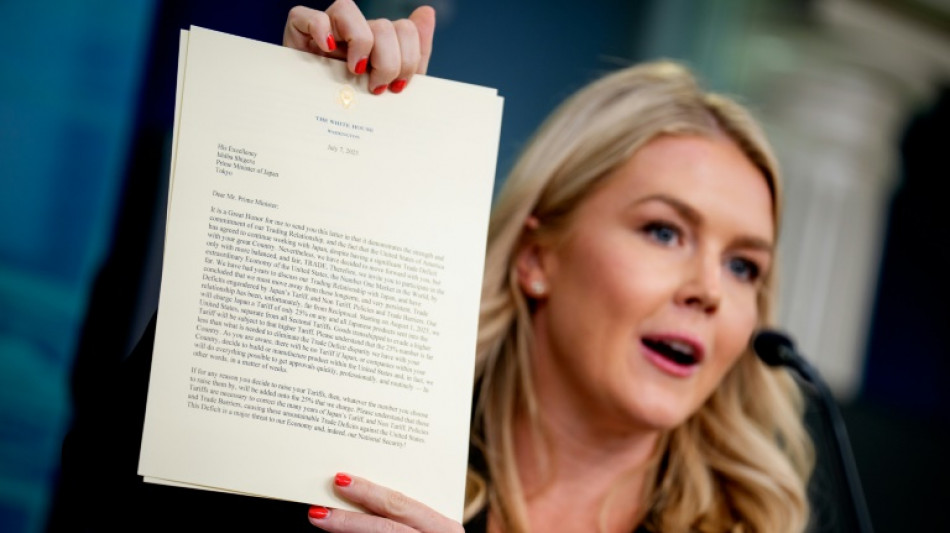

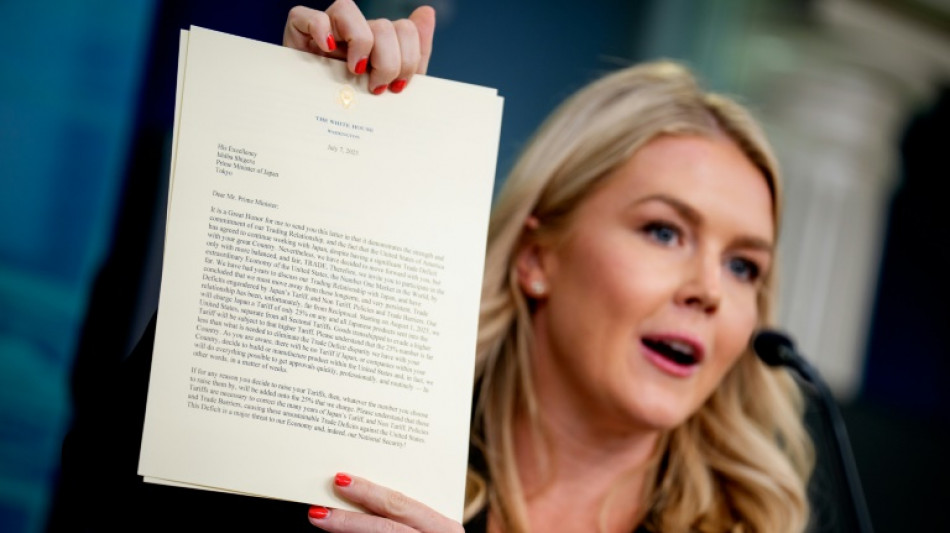

After warning of a tariff hike of 10 percent on countries aligning themselves with the emerging BRICS nations, Trump announced plans for 25 percent tariffs on Japan and South Korea from August 1 if the countries do not reach a deal.

Trump issued similar letters to South Africa, Malaysia, Myanmar, Laos and Kazakhstan, saying he would slap duties on their products ranging from 25 percent to 40 percent.

Later Monday, he announced additional levies on Indonesia, Cambodia and other countries.

The broadsides revived attention on trade after the issue had receded for a few weeks while Congress debated Trump's sweeping fiscal package and worries about the Iran-Israel conflict took certain stage.

Major US indices fell, with the S&P falling 0.8 percent, retreating from a record.

The likelihood that Trump's statements are a bargaining tactic is one reason losses weren't "even worse," said Steve Sosnick of Interactive Brokers.

"No one really wants to overreact negatively right now, which is why we're seeing a bit of a sell-off, but not a major sell-off," he said.

The White House has said several deals were in the pipeline but only two have been finalized so far, with Britain and Vietnam.

The administration had previously set a July 9 deadline to reach agreements. The White House now says it will hike tariffs on August 1 on trading partners that don't strike a deal.

Despite the tariff uncertainty, official data Monday showed German industrial production rose strongly in May, boosting hopes that Europe's top economy has turned a corner.

The news lifted German equities which gained 1.2 percent for the day.

Paris added 0.4 percent, while London dipped 0.2 percent.

Asia's main stock markets mostly steadied.

- OPEC+ hike -

The oil market was also in focus after Saudi Arabia, Russia and six other key members of the OPEC+ alliance said they would increase oil output in August by 548,000 barrels per day, more than expected.

The group said in a statement that "a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories," led to the decision.

IG analyst Chris Beauchamp said that crude prices would ordinarily be expected to drop when additional supply is being brought to market.

"Crude’s strength today suggests that buying momentum is clearly picking up," he said.

"The bearish theme that has dominated for so long seems to have run its course, even if more increases are expected in September," he added.

Among individual companies, Tesla tumbled 6.8 percent after Trump blasted CEO Elon Musk's plan to launch a new political party in opposition to the president's hallmark legislation, the so-called "Big Beautiful Bill."

The back-and-forth escalated a conflict between the president and the world's richest man at a time when investors had hoped Musk would refocus on Tesla and his other ventures and shift attention from politics.

- Key figures at around 2030 GMT -

New York - Dow: DOWN 0.9 percent at 44,406.36 (close)

New York - S&P 500: DOWN 0.8 percent at 6,229.98 (close)

New York - Nasdaq Composite: DOWN 0.9 percent at 20,412.52 (close)

London - FTSE 100: DOWN 0.2 percent at 8,806.53 (close)

Paris - CAC 40: UP 0.4 percent at 7,723.47 (close)

Frankfurt - DAX: UP 0.1.2 percent at 24,073.67 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 39,587.68 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,887.83 (close)

Shanghai - Composite: FLAT at 3,473.13 (close)

Euro/dollar: DOWN at $1.1710 from $1.1778 on Friday

Pound/dollar: DOWN at $1.3602 from $1.3650

Dollar/yen: UP at 146.13 yen from 144.47 yen

Euro/pound: DOWN at 86.09 pence from 86.30 pence

Brent North Sea Crude: UP 1.9 percent at $69.58 per barrel

West Texas Intermediate: UP 1.4 percent at $67.93 per barrel

burs-jmb/ksb

(Y.Berger--BBZ)