RBGPF

0.0000

Wall Street stocks rose again Wednesday, shrugging off the partial US government shutdown as major indices finished at records amid hopes for more Federal Reserve interest rate cuts.

Both the Dow and S&P 500 closed at fresh records as investors focused on poor US employment data, which boosted expectations that the Fed could cut interest rates later this month.

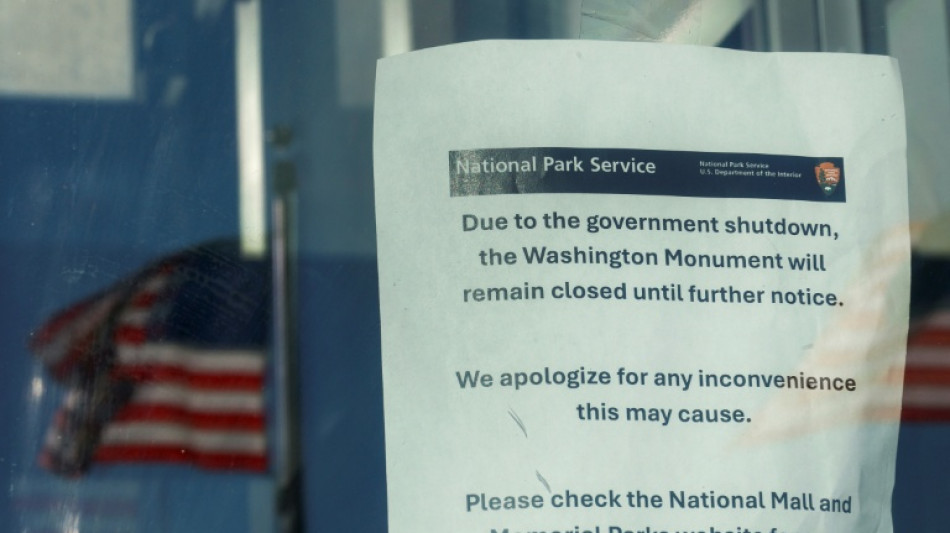

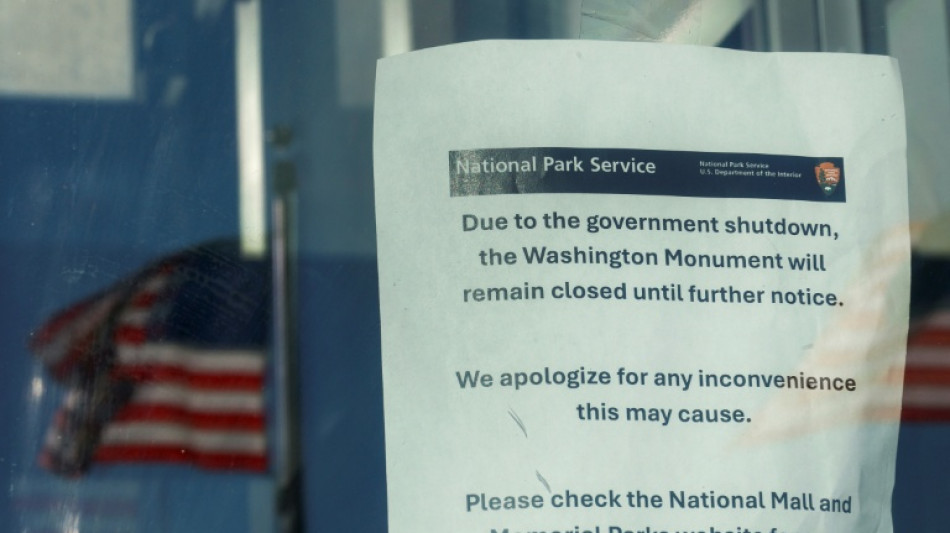

US government operations began grinding to a halt at 12:01 am (0401 GMT) Wednesday after Republicans and Democrats failed to break a budget impasse in Congress.

The closure will see non-essential operations halted, leaving hundreds of thousands of civil servants temporarily unpaid, and many social safety net benefit payments potentially disrupted.

But analysts note that shutdowns have not significantly weighed on markets due in part to the view that the negative impacts from closures can be reversed once the government reopens.

"History reminds us that government shutdowns have typically been more headline-making than bottom-line impacting," said CFRA Research's Sam Stovall.

Investors took note of a report from payroll firm ADP that showed the US private sector shed 32,000 jobs last month.

"The market's getting a little bit excited that this is something where the Fed can continue cutting interest rates," said Tim Urbanowicz, chief investment strategist at Innovator Capital Management. "There's this kind of middle ground where the data is not showing a lot of strength, but it's not weak enough where people start getting concerned about recession."

Analysts said the weaker job market cements expectations that the Fed will cut interest rates twice more this year, after lowering borrowing costs last month for the first time since December.

But investors are concerned the US government shutdown could prevent the release Friday of the key non-farm payrolls report -- a crucial data point for the Fed on rate decisions.

European markets were lifted by pharmaceutical shares after Pfizer was granted reprieve from Trump's tariffs by agreeing to lower drug prices in the United States.

Shares in British pharma giant AstraZeneca rose more than eight percent and GSK was up over six percent in London.

Several US pharma names also rose, including Merck and Bristol-Myers Squibb, while Lithium Americas Corp. surged 23.3 percent after announcing it would grant the US government an equity stake as part of the restructuring of a loan from the Department of Energy.

In Asia, Tokyo's stock market sank, while Hong Kong and Shanghai were closed for holidays.

- Key figures at around 2030 GMT -

New York - Dow: UP 0.1 percent at 46,441.10 (close)

New York - S&P 500: UP 0.3 percent at 6,711.20 (close)

New York - Nasdaq Composite: UP 0.4 percent at 22,755.16 (close)

London - FTSE 100: UP 1.0 percent at 9,446.43 (close)

Paris - CAC 40: UP 0.9 percent at 7,966.95 (close)

Frankfurt - DAX: UP 1.0 percent at 24,113.62 (close)

Tokyo - Nikkei 225: DOWN 0.9 percent at 44,550.85 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1728 from $1.1734 on Tuesday

Pound/dollar: UP at $1.3476 from $1.3446

Dollar/yen: DOWN at 147.14 yen from 147.90 yen

Euro/pound: DOWN at 87.04 pence from 87.27 pence

West Texas Intermediate: DOWN 0.9 percent at $61.78 per barrel

Brent North Sea Crude: DOWN 1.0 percent at $65.35 per barrel

burs-jmb/ksb

(A.Berg--BBZ)